Monday, 31 August 2015

Monday, 23 March 2015

Out 'Hodgeing' Margaret Hodge

Here is a clip from this afternoon's Public Accounts Committee hearing with Edward Troup (HMRC) about the 114,000 NonDoms living in the UK. Great 'rant' by Richard Bacon MP (Con. Sth Norfolk).

Alternatively link for iPad users Here

Saturday, 28 February 2015

Am I the only one to smell another City/HMRC rat?

A certain unnamed banking CEO (click here [FT£]) gave some interesting evidence this week to the Parliamentary Treasury Select Committee. (His name is apt given his attitude to us 'little people').

He seems to have gone to great deal of trouble to set up an elaborate financial structure for his pay involving:-

1. Registering with HMRC as a UK Non-Don (non-domicile resident) exempting him from tax on 'overseas' earnings despite being born and bred in the UK and living and working in London for the past 12 years.

2. Designating himself as one of handful of ‘internationally mobile’ employees being paid, not in London, but via one of the Bank’s subsidiaries in the Netherlands thus avoiding that pesky P.A.Y.E. that 'little people' pay. This of course would count as non-taxed ‘overseas earnings’ for UK non-doms.

2. Designating himself as one of handful of ‘internationally mobile’ employees being paid, not in London, but via one of the Bank’s subsidiaries in the Netherlands thus avoiding that pesky P.A.Y.E. that 'little people' pay. This of course would count as non-taxed ‘overseas earnings’ for UK non-doms.

3. Having his pay and bonuses paid into his Swiss Bank account via a shadow company he had set up in Panama.

Having done all this, he claims that he (has now) paid his UK taxes in full.

Do I spot another HMRC sweetheart deal letting the big fish off the hook as long as they pay up after they have been caught? Would someone really pay the £30k non-dom 'fee' for no reason?

The simple fact is that these guys have the power to move 'their' bank's H.Q. at will out of London to Hong Kong, Dubai, Singapore (or Panama) where the governments don't care a jot about paying for a civilised society although they seem very happy to 'free load' off the rest of us and live here themselves. Both the Bankers and MPs know who has the ultimate power and it isn't the MPs.

Here is the (4 hour) video of the Treasury Select Committee if you have wish to be very depressed about the competence and morality of these guys.

See 15:30 - We quickly instigated a cover up in our other High Net Worth personal banking locations.

Also 15:34 - Threat to leave the UK if you upset us.

The simple fact is that these guys have the power to move 'their' bank's H.Q. at will out of London to Hong Kong, Dubai, Singapore (or Panama) where the governments don't care a jot about paying for a civilised society although they seem very happy to 'free load' off the rest of us and live here themselves. Both the Bankers and MPs know who has the ultimate power and it isn't the MPs.

Here is the (4 hour) video of the Treasury Select Committee if you have wish to be very depressed about the competence and morality of these guys.

See 15:30 - We quickly instigated a cover up in our other High Net Worth personal banking locations.

Also 15:34 - Threat to leave the UK if you upset us.

And 15:51 - John Mann MP.

Wednesday, 25 February 2015

Why companies DO pay tax and not just pass it on to their customers

Let us take for our example a company with a pre-tax profit of £100m per annum.

At the old UK Corporation Tax rate (of 28%) they would have paid £28m in Corporation Tax.

Now, with the coalition 'business friendly' UK Government, Corporation Tax has been reduced to 21% giving the company directors the happy task of deciding what to do with the windfall £7m spare cash.

This is how I see their options:-

1/ Pay themselves the money as a 'reward' for their inspired business leadership.

2/ Put the money in an offshore account to secure company profitability for subsequent years.

3/ Pay the money out to shareholders.

4/ Invest in expansion of the company.

5/ Give the company workforce a pay rise. (just kidding)

6/ Use some of it to make a large contribution to a political party to reduce Corporation Tax to 15% next year.

7/ Reduce prices for the company's customers.

Now, which option do you think they would choose?

As the executives, more than likely, have advantageous tax exile or non-dom status, corporation tax is the ONLY way to gain any tax revenue from them.

Thursday, 22 January 2015

Cartels, my Grandfather and the Super Rich

Yes, I have been pondering (a

joy of being retired) about what has happened in my lifetime to produce the

Super Rich (Davos et al.).

Why doesn’t the Capitalist treasured

concept of ‘free market forces’ limit these excesses?

I have concluded ‘it

never did!’

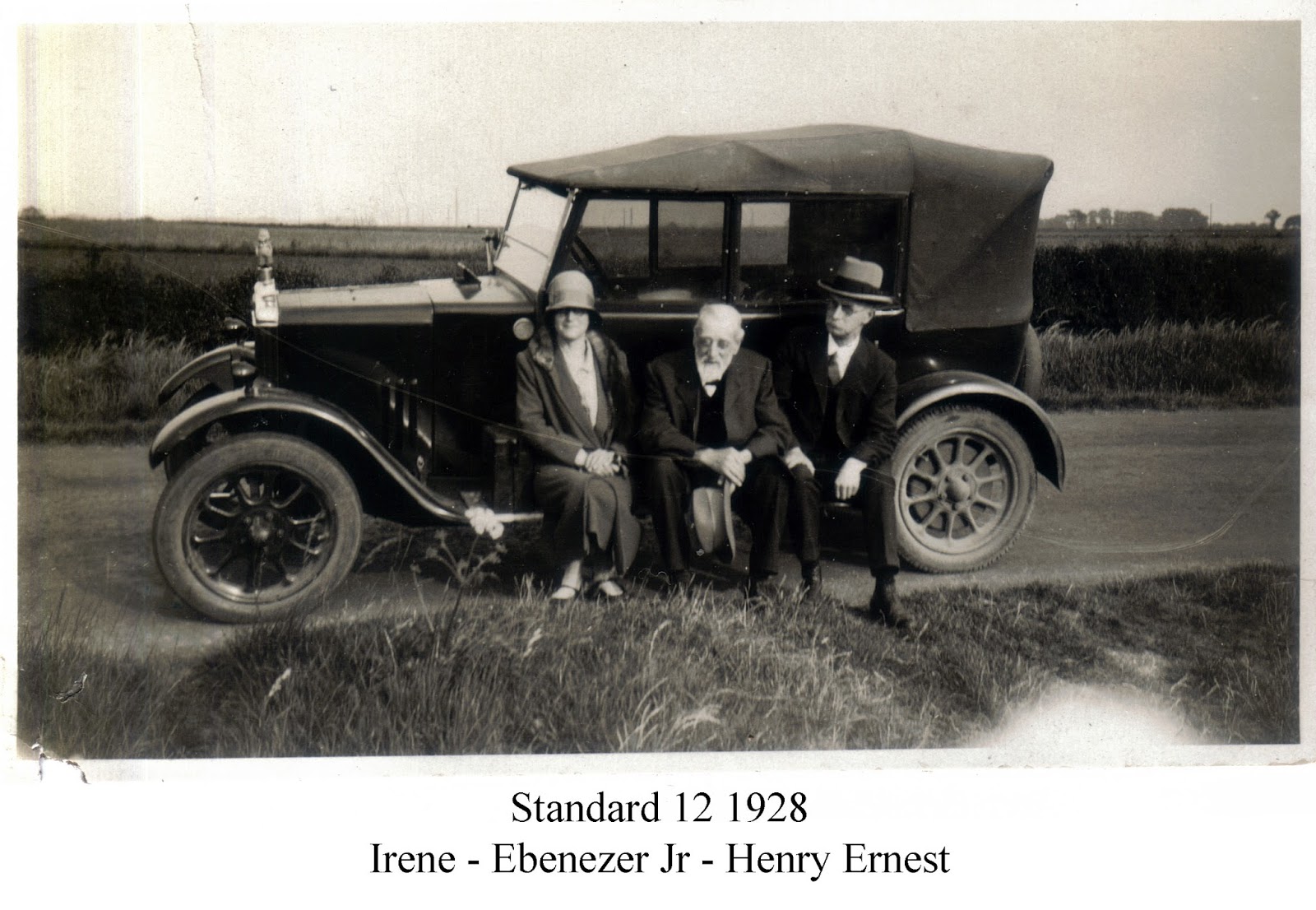

My Grandfather (Henry Ernest)

and Great Grandfather (Ebenezer) owned a grocery shop in Biggleswade (just 50

miles up the A1) from London.

My Grandfather (Henry Ernest)

and Great Grandfather (Ebenezer) owned a grocery shop in Biggleswade (just 50

miles up the A1) from London.

They were part of the small

town’s prosperous business community, owning a car before WWII and living in a

large detached house, which had the first domestic heating system (back boiler &

hot water tank) in the town. Ebenezer was on the board of the local Workhouse

(he stood out against the men having a glass of beer at Christmas as he was a good Methodist).

I have concluded that they, and

the say four other grocers in the town, operated an informal Cartel.

I am not saying they liked their competitors but neither were

they in the business of slashing their prices to drive them out of business. As

long as they had a ‘reasonable’ share of the town’s grocery trade they were

definitely NOT going to rock the boat.

The gap between them and the

inmates of the said Workhouse was quite wide but nowhere near as wide as

between the average citizen and the Super Rich we see today.

The simple fact is the same

‘informal’ Cartels exist today but on a much larger scale. This is due to much better logistics and computer based

information systems available to the big boys which allows them to operate on a

national (Sainsbury’s) or international (Lidl) level.

A new entrant into the UK energy

(such as Ovo Energy) have no interest of ‘slashing its prices’ once it has

established a ‘reasonable’ market share. They are all creaming it!

The problem is a massive one

that could well destabilise our society and cause civil unrest and I cannot think how mere politicians

can legislate to tackle it.

Comments welcomed.

Subscribe to:

Posts (Atom)